Companies often spend hundreds of thousands if not millions of dollars on their Anaplan implementations and upkeep. Professional Anaplan implementors spend hundreds of hours on Anaplan’s training courses. Even though the average ROI is extremely high for Anaplan implementations, it would be a complete loss if Anaplan shut down services or went out of business. While many of us know what services Anaplan has to offer and how we can leverage them to maximize our business planning, we seldom think of the potential risks in using 3rd party software as an integral part of our businesses and livelihoods as both model builders and end-users. In this article, we will be taking a deep dive into Anaplan as a business and its financials to see if any worries are warranted.

At the time of writing this, Anaplan stock (ticker: PLAN) has performed extremely well since its IPO debut in 2018. Since it is a tech company, COVID-19 has not seemed to seriously hinder its accent. The stock’s performance is a very good sign as it means investors are very bullish about this pre-profit company’s future. While we are not looking into the potential profitability of an investment into Anaplan stock, it is always good to know that investors are confident in a company’s future. Now let’s take a look under the hood at the actual financials.

You can find Anaplan’s actual financial reports and accompanying documents here.

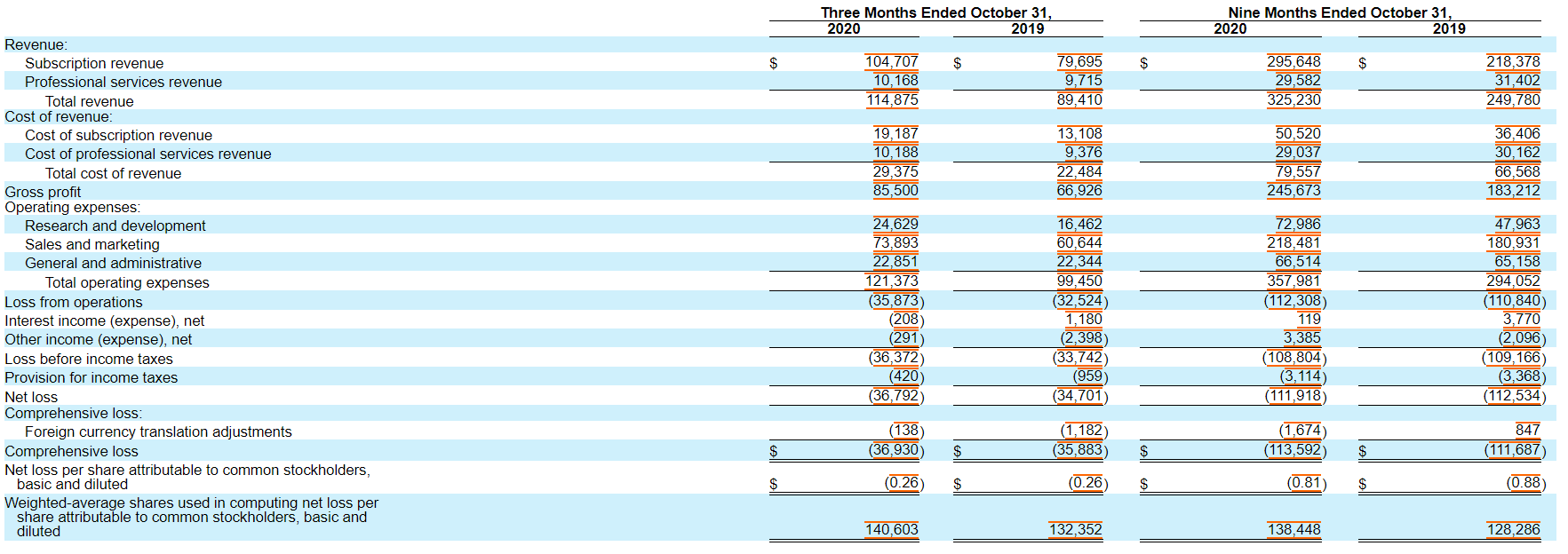

First, since Anaplan is a pre-profit company, it is important to know how much cash runway it has before more funding is needed. According to their quarterly report (10-q), Anaplan had about $297 million in cash and cash equivalents and no debt. Anaplan suffered a net loss in the 3rd quarter of 2020 of about $37 million, higher than the 3rd quarter of 2019 by $2 million. Assuming their net income stays about constant and barring all other current factors, Anaplan has about 2 years left before they run out of cash. While not the longest time, it is still a good sign as to Anaplan’s health. To extend this runway they could always take on debt or issue more stock. From the perspective of an Anaplan user rather than an investor, the latter option is very attractive as it adds funding without the need to take on potentially dangerous debt and there is little to no downside to someone who isn’t a shareholder risking dilution.

Even if Anaplan can stay afloat for a long time without turning a profit, unprofitable companies definitely can’t survive forever. A deeper dive into their income statement will show what factors are keeping them from being profitable.

It is important to remember that Anaplan uses the now popular product as a service business model, which will justify many of its current expenses. Since 2019, the cost of revenue has scaled pretty closely with the total revenue. As with many subscription services the cost of the subscription revenue is only a small fraction of the actual subscription revenue. Anaplan maintains a high gross profit that has been consistently growing. Within the operating expenses, there are also some very good signs. First, general and administrative expenses have not grown considerably from prior periods. Research and development have grown; however, R&D is more like an investment than a real cost when done correctly. The investment into R&D will improve Anaplan’s platform which directly positively affects you or your company. Similarly, since companies pay regular subscription fees to Anaplan, sales and marketing are also more like investments to bring in new enterprises. Both of these expenses could probably be lowered if needed without much detrimental effect.

While what has been discussed above is useful in a stagnant world, ours is one of constant change and adaptation. Anaplan’s future financial status is all but certain to change over time (in fact that’s what Anaplan investors are betting on since Anaplan is currently pre-profit). Anaplan is currently focusing on high growth. Working with a growing company is always a good sign as to the quality and stability of their service. Consider that the number of customers who provided a recurring revenue of over $250,000 grew from 353 in January 2020 to 417 in October of 2020. That is an 18% increase in just 9 months. Furthermore, there are plenty of companies large enough to implement Anaplan around the world in the future. This should provide good job security for Anaplan model builders.

From a consumer’s perspective, competition is almost always a good thing. When shopping for software for your company, you probably reviewed the numerous solutions before settling on Anaplan. Competition is stiff in the Financial Software world and Anaplan faces numerous large competitors. Some of the names include SAP, Oracle, Workday, IBM, OneStream, and more “which are well-established providers of business planning and analytics software with long-standing relationships with many customers… Oracle, SAP, and IBM are larger than we are and have greater name recognition, longer operating histories, larger marketing budgets, and significantly greater resources than we do.” (2020 Anaplan 10-k) On top of this Anaplan competes with a plethora of software that overlaps slightly or in some use cases with Anaplan’s platform. Some companies may always opt for the spreadsheet over a long and expensive Anaplan implementation even if the ROI pays for itself many times over. Anaplan also has advantages over its competitors such as Hyperblock and other things. Also, many of the competitor’s platforms simply are not as good as Anaplan’s platform in many use cases. It is hard to say how Anaplan will be affected by its competition. So far, however, Anaplan has been very successful in entering this crowded market.

Anaplan’s corporate management team provides an impressive line-up of skills and previous important roles in companies such as IBM, Red Hat, Adobe, Cisco, GM, and more. The Chief Customer Officer, Simon Tucker, has been with Anaplan since 2009. Having a strong team is always a good sign for a company’s future in growth and product development.

While by no means does this article cover the validity of an investment into Anaplan stock, nor does it pretend to predict the future with any sort of accuracy, it should give you the confidence that Anaplan will probably not be going anywhere any time soon. This is important for both Companies that have implemented Anaplan who rely upon it for FP&A and other uses and the implementors of Anaplan whose livelihoods depend upon it. Anaplan has strong financials, a strong product, high growth, and a bright future.

Interested in hiring our Concessio consultants to help your Anaplan implementation? Visit our website’s Anaplan page here.

no replies